Virginia Selects Voltus as Demand Response Provider | American Public Power Association

Voltus Inc. has been chosen as the preferred vendor for the demand response program for the Virginia Department of Energy, Voltus said on Feb. 21.

View your demand response program enrollment and how much you are forecasted to earn. Sort, segment, and download your data for internal budgeting and planning.

View your earnings and payments in aggregate or on an individual site or program level. Easily access your last payment amount and status.

Better understand your demand response performance and optimize your energy spend by viewing your 30-second interval data anytime, anywhere.

Leverage real-time energy data to track your event performance in real time with clear curtailment targets. View past performance in aggregate or individually by site.

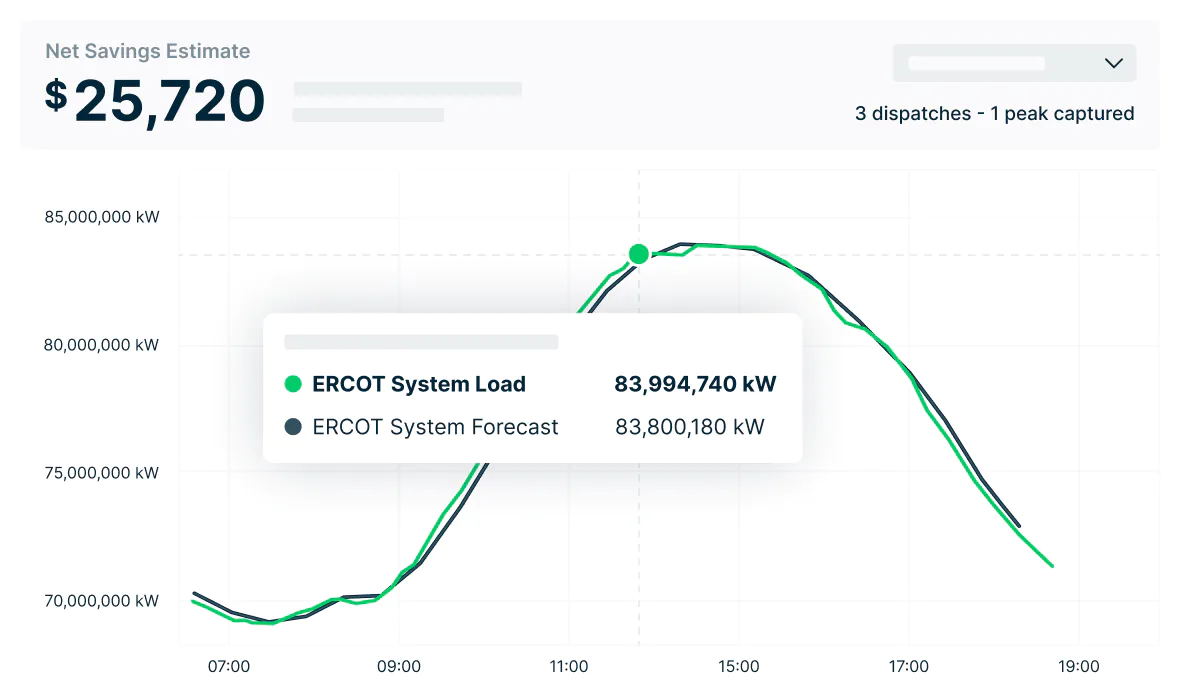

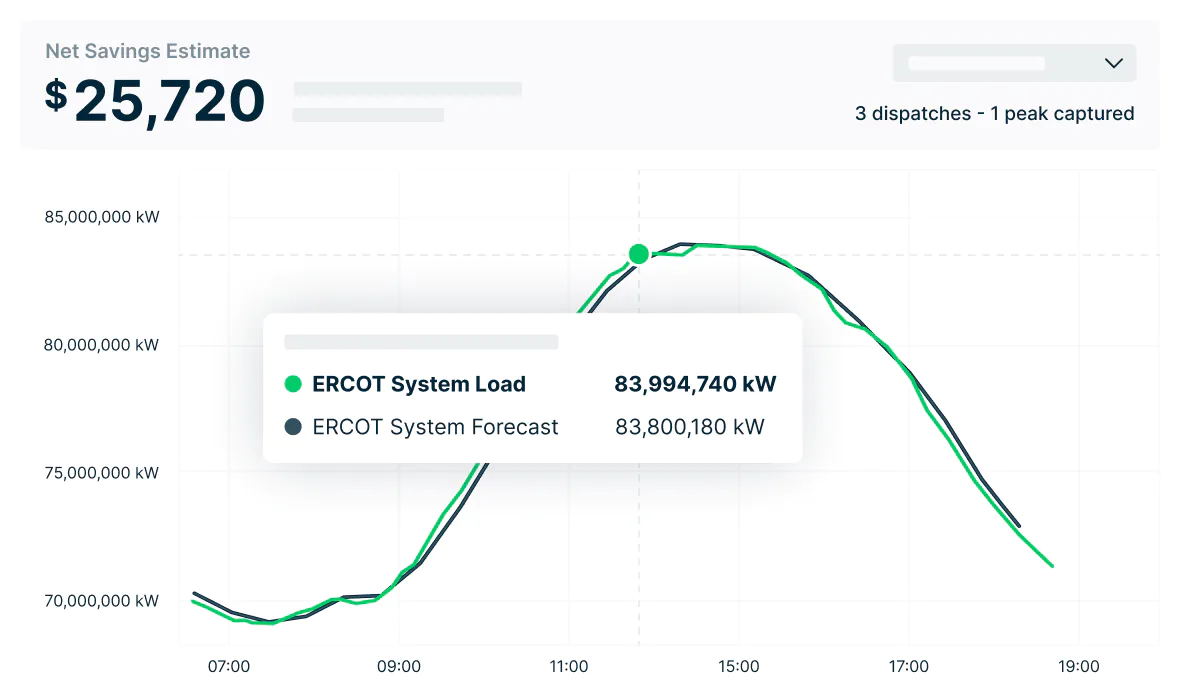

View current system load for your grid operator. View and compare historical and forecast peaks for additional intelligence.

Quantify and better understand avoided CO2 emissions from demand response program participation with intuitive equivalencies. Incorporate exported data into your overall sustainability reporting.

View your demand response program enrollment and how much you are forecasted to earn. Sort, segment, and download your data for internal budgeting and planning.

View your earnings and payments in aggregate or on an individual site or program level. Easily access your last payment amount and status.

Better understand your demand response performance and optimize your energy spend by viewing your 30-second interval data anytime, anywhere.

Leverage real-time energy data to track your event performance in real-time with clear curtailment targets. View past performance in aggregate or individually by site.

View current system load for your grid operator. View and compare historical and forecast peaks for additional intelligence.

Quantify and better understand avoided CO2 emissions from demand response program participation with intuitive equivalencies. Incorporate exported data into your overall sustainability reporting.

Real-time visibility into dispatch performance drives earnings and savings in real time

Alerting and performance coaching communicated through your Voltus account

Voltus technology optimizes kW nominations to create more cash for your business

“With Voltus’s demand response services, we achieved a 50% reduction in curtailments and an impressive 20% improvement in performance. In addition, we gained access to real-time energy data for our facilities - from virtually anywhere, which is truly amazing!”

“When Voltus entered the picture, we were introduced to a new way of earning cash through demand response - and there is zero cost associated with it.”